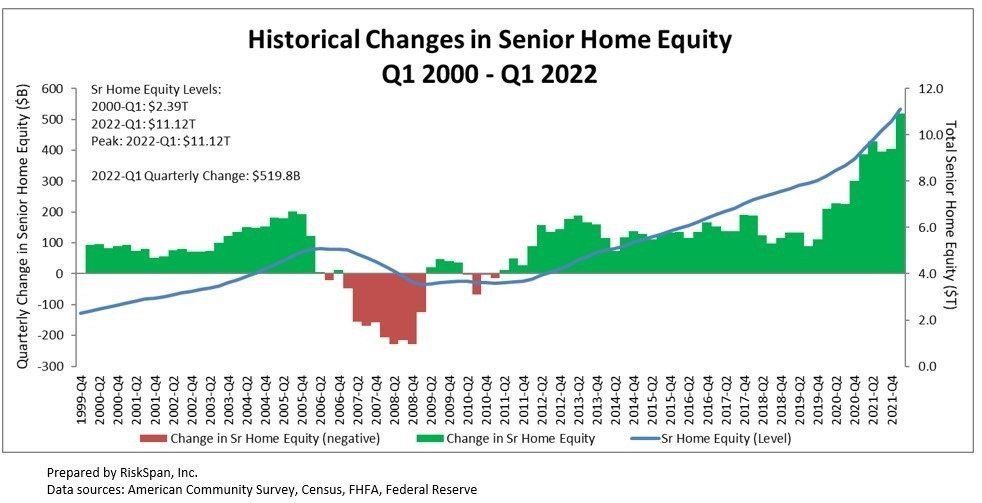

Senior Home Equity Exceeds Record $11.12 Trillion

Homeowners 62 and older saw their housing wealth grow by 4.91 percent or $520 billion in the first quarter to a record $11.12 trillion from Q4 2021, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

The NRMLA/RiskSpan Reverse Mortgage Market Index (RMMI) rose in Q1 2022 to 388.83, another all-time high since the index was first published in 2000. The increase in older homeowners’ wealth was mainly driven by an estimated 4.4 percent or $563 billion increase in home values, offset by a 2.06 percent or $43 billion increase in senior-held mortgage debt.

NRMLA President Steve Irwin, said: “Inflationary fears, market volatility and concerns about a possible recession have created a great deal of anxiety for America’s aging population. Now may be an appropriate time to consider the strategic use of home equity to help improve older homeowners’ retirement security.”

About Reverse Mortgages

Reverse mortgages are available to homeowners who are 62 and older with significant home equity. They are a versatile financial tool that seniors can use to borrow against the equity in their home without having to make monthly principal or interest payments as with a traditional “forward” mortgage or a home equity loan. Under a reverse mortgage, funds are advanced to the borrower and interest accrues, but the outstanding balance is not due until the last borrower leaves the home, sells or passes away.

To date, more than 1.21 million households have utilized an FHA-insured reverse mortgage to help meet their financial needs.

For more information about Reverse Mortgages check out our Reverse Mortgage Blog & Frequently Asked Questions.

Have A Question?

Use the form below and we will give your our expert answers!

Reverse Mortgage Ask A Question

Start Your Loan

with DDA todayYour local Mortgage Broker

Mortgage Broker Largo See our Reviews

Looking for more details? Listen to our extended podcast!

Check out our other helpful videos to learn more about credit and residential mortgages.