Call (727) 784-5555

The Real estate market is shifting and now a great opportunity for buyers to get a home with out being with many others competing for the same home. Watch our video and learn more on the change, interest rates and, what is to come.

The marketing is shifting away from sellers and in favor of homebuyers.

The housing market has shifted and it is becoming easier for homebuyers to win bids and purchase a home. Before the market shift, buyers had to compete with multiple bids on a house and they had to bid over the asking price. Now, there are fewer buyers entering the market, so homes are less competitive.

Also, buyers are able to offer the asking price or below the asking price on some homes without having to worry about another buyer outbidding them.

Pre-approval still matters.

Buyers still have to be pre-approved and have pre-approval letters. DDA Mortgage can get you pre-approved over the phone or you can start the process online at no cost to you. We have lots of loan options available and our specialist will help you find the right terms for you.

After being approved for a mortgage loan, you will have a letter from them stating your approved amount which can be used when making an offer on a home.

If you are worried about rising interest rates, you should consider these things.

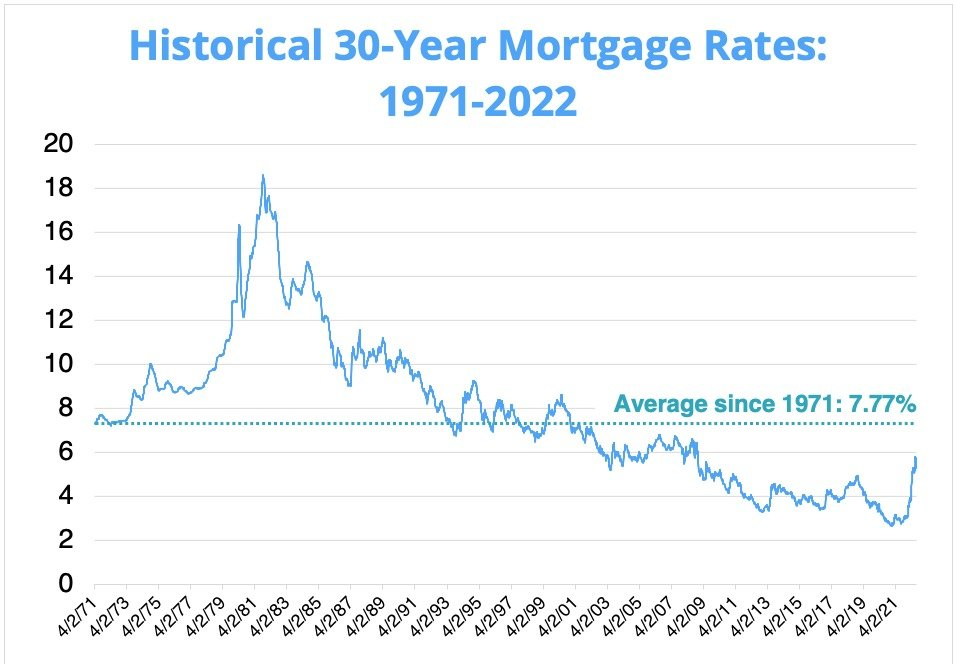

Interest rates are still below the 50-year average. It is still a good time to finance a home, especially if you have good credit and can afford the monthly payments.

Chart represents weekly averages for a 30-year fixed-rate mortgage. Source: Freddie Mac & The Mortgage Reports

If you're worried about interest rates going up in the near future, it's important to remember that you can lock into a 30-year mortgage right away. The best part is you can always refinance when rates drop.

There are a lot of things that go into buying a home, but don't make it more complicated than it needs to be. Focus on the house, what you want, and can you afford the monthly payment.

Use the form below and one of our specialists will review your numbers and help you determine what you can afford. Or call us at (727) 784-5555 to learn more about your options.

Contact A Specialist

Use the form below and we will give your our expert answers!

Non QM Ask A Question

We will get back to you as soon as possible.

Please try again later.

Start Your Loan

with DDA todayYour local Mortgage Broker

Mortgage Broker Largo See our Reviews

Looking for more details? Listen to our extended podcast!

Check out our other helpful videos to learn more about credit and residential mortgages.