What has happened to the mortgage industry in 2022

Mortgage rates started off at a record low in 2022. It was an exciting time for many homeowners, and a great opportunity to lock in a low rate on a mortgage. Low-interest rates also brought many buyers to the market causing home prices to increase as homes received multiple bids and offers over the asking price.

Mortgage Changes In The 2nd Quarter Of 2022

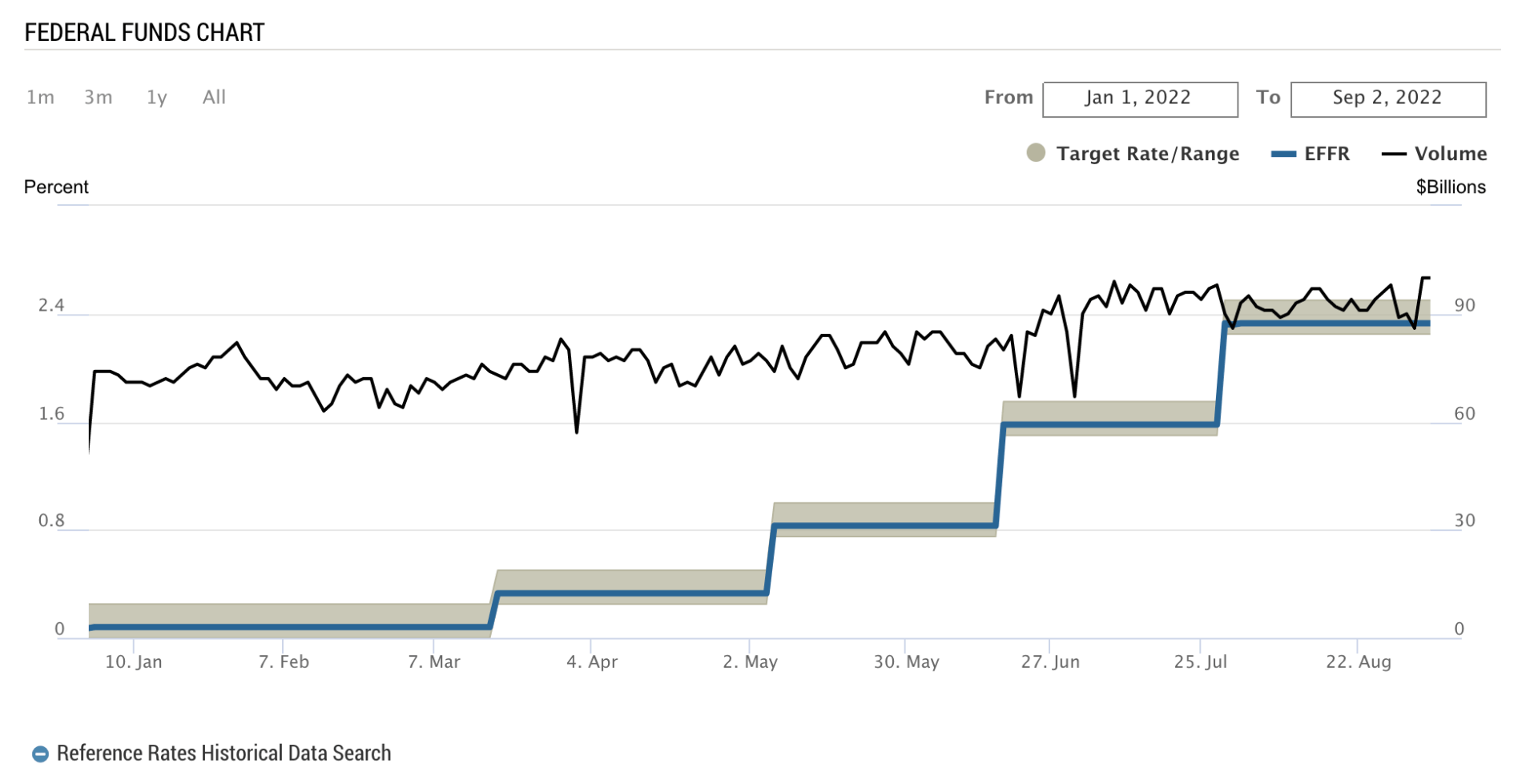

But things would quickly change in the second quarter of 2022 as the government decided to increase the federal funds rate to fight inflation starting in March. Higher rates made borrowing money more expensive, and the monthly out-of-pocket cost to borrowers increased. The FED has continued to raise the effective federal funds rate in an effort to combat inflation. The chart below shows the Effective Federal Funds Rate as reported by the New York FED.

Shifts In Mortgage Demand And Lender Supply

As the demand for mortgages has declined, the industry has had to shift. Some companies have been laying off employees. Non-QM lenders are having more trouble selling securities, and some lenders have decided to shut down altogether and stop lending.

What Should Homebuyers Expect

Buyers with strong financial positions are in great shape. There are less buyers in the market. That means there is less competition for homes and prices are stabilizing.

Buyers are being scrutinized more during the lending process. Underwriters are asking for more documentation and are asking for additional verification. The lenders want to make sure they can sell the loan, and if they have good documentation, they can.

Rates will inevitably come down. And borrowers at today's rate can always refinance into a lower rate.

Next Steps

If you are shopping for a mortgage, call us now a (727) 784-5555. We will get you approved and close quickly without unexpected surprises.

If you have questions about mortgages and home loans, please ask using the form below.

Ask a Question

Use the form below and we will give your our expert answers!